Call Us Back

Kindly fill the above infomation and one of our executive will call you in 48 Hr.

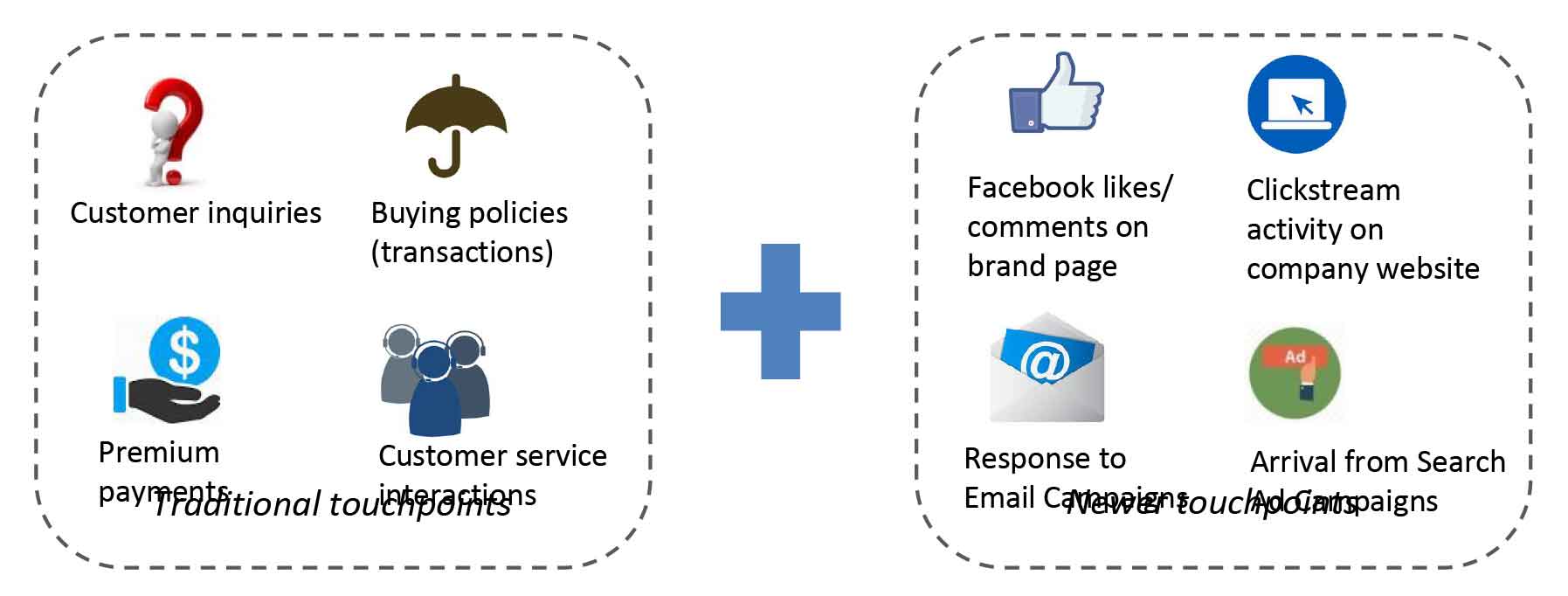

Customer touch points have exploded in the last few years, especially due to increase in digital interactions

The benefits of getting a comprehensive view of customers are many,

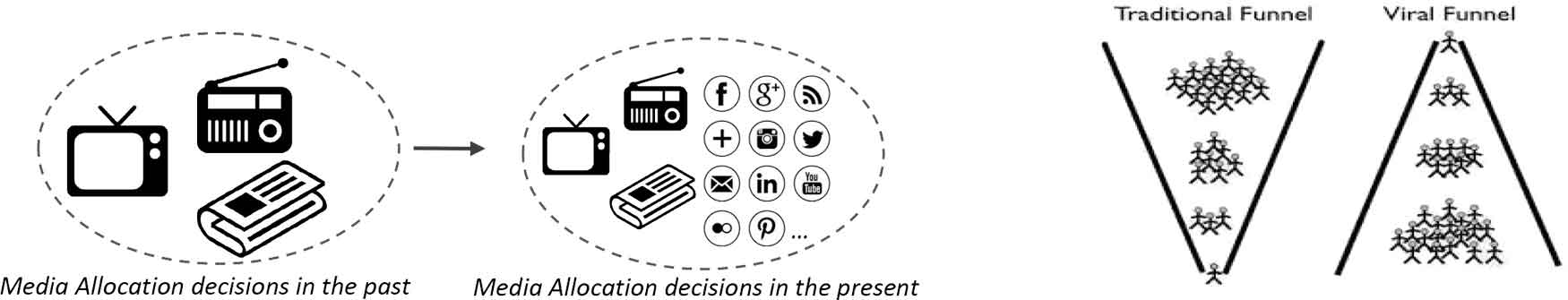

Media consumption has become extremely fragmented with customers spending more time on online and mobile platforms

Consumer behavior is now influenced at various moments and touchpoints and the traditional marketing funnel has become less applicable.

Keywords from raw data

Identifying patterns